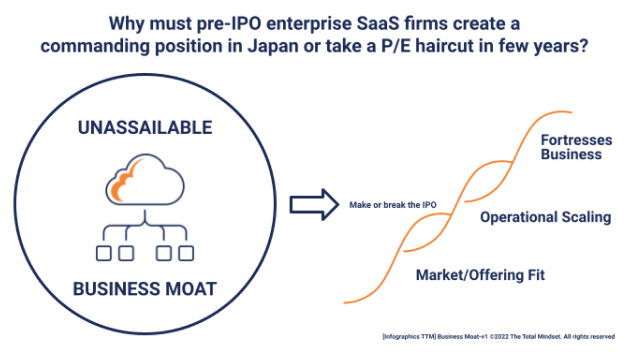

Enterprise Software constitutes a global market. Financial analysts and late-stage momentum investors expect enterprise software providers to have a dominant, if not unassailable, position in all major markets. This means building a moat around the core business: growing ARR and net retention rates of 105 percent.

Despite the lucrative and dense nature of the Japanese market, pre-IPO software firms struggle to capitalize on the opportunity. A cold start to develop a Japan market often requires an investment of a full year just to set-up an office with a country manager and as much as a million dollars all inclusive (including multiple trans-Pacific trips).

Then the real work begins, often with the discovery that they may have hired an under-performing leader who requires a lot more support than the N. American or European firms can provide.

This can lead to another lost year or two of missed revenues and climbing expenses.

This Executive Primer blog series is about how to cut the time-to-breakeven with enterprise Japanese revenues by 50 to 75 percent.

Japan is the world’s second largest market for enterprise software with $18B in purchases with 22 million consumers in Greater Tokyo and a density of potential business customers twice the size of metropolitan New York.

QUICK FACT OVERVIEW

- Japan is the second largest enterprise software market in the world.

- Japan typically garners 60 to 70 percent of Asia Pacific (excluding China) for enterprise software companies.

- Their 2020 enterprise software market value was $11 billion USD.

- In 2021 it reached $19 billion USD with 31% in SaaS.

- Japan is “cloud ready”.

- Their 2023 public cloud market will grow at 18%, exceeding $24 billion.

- While not unique in the world, Japanese clients pay their bills on time and remain loyal to their vendors.

- Long-term, irreversible decline in population continues to send shockwaves through Japanese society and its businesses.

- One primary consequence is the existential need to systematize, digitize, and outsource often core aspects of business operations.

- In many aspects, Japan will pace the world in Industry 4.0 technology and systemic digital transformations.